What Is The Low Rate Threshold For Superannuation . Minimum pension drawdown rates and calculator. The rate will gradually increase to 12%. For previous years, see low rate cap amount. Take a look at the new numbers to check for opportunities. A new financial year brings updated thresholds for a range of super measures. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. rates and thresholds apply to contributions, employment termination payments, super guarantee and co.

from sfasydney.com.au

the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. The rate will gradually increase to 12%. Minimum pension drawdown rates and calculator. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. For previous years, see low rate cap amount. A new financial year brings updated thresholds for a range of super measures. Take a look at the new numbers to check for opportunities.

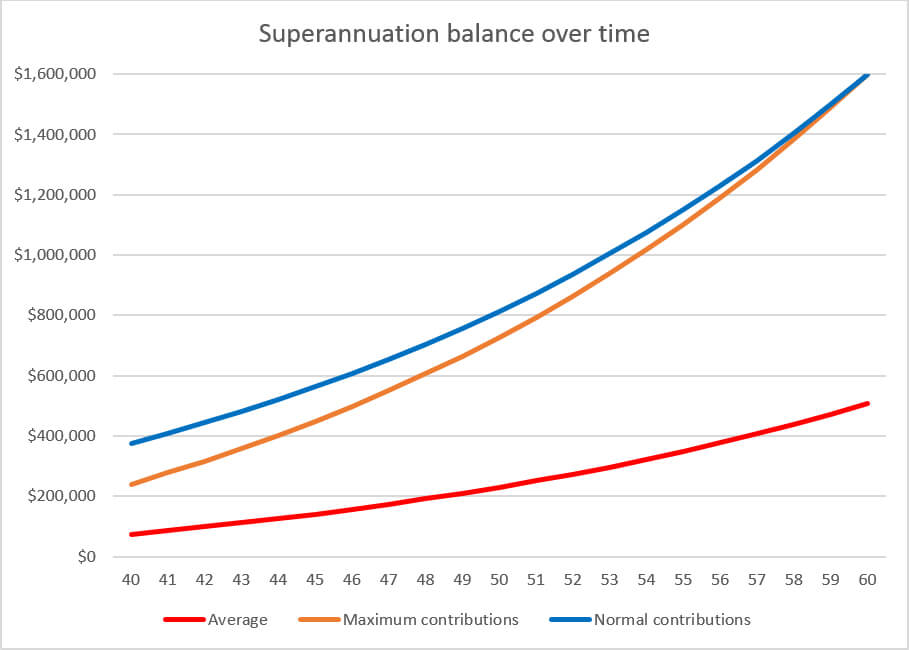

How much Superannuation should I have at age 40? Strategic Financial

What Is The Low Rate Threshold For Superannuation rates and thresholds apply to contributions, employment termination payments, super guarantee and co. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. A new financial year brings updated thresholds for a range of super measures. The rate will gradually increase to 12%. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Take a look at the new numbers to check for opportunities. Minimum pension drawdown rates and calculator. For previous years, see low rate cap amount.

From www.savvy.com.au

Superannuation in Australia, 2022 Survey Men Twice as Likely as Women What Is The Low Rate Threshold For Superannuation The rate will gradually increase to 12%. Minimum pension drawdown rates and calculator. A new financial year brings updated thresholds for a range of super measures. For previous years, see low rate cap amount. Take a look at the new numbers to check for opportunities. the low rate cap amount is the limit set on the amount of taxable. What Is The Low Rate Threshold For Superannuation.

From weareaccountable.com.au

11 tax facts about superannuation Account(able) Accountants Pty Ltd What Is The Low Rate Threshold For Superannuation For previous years, see low rate cap amount. A new financial year brings updated thresholds for a range of super measures. The rate will gradually increase to 12%. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. rates and thresholds apply to contributions, employment termination payments, super guarantee and. What Is The Low Rate Threshold For Superannuation.

From franchiseexecutives.com.au

Superannuation rates rise what you need to know as an employer What Is The Low Rate Threshold For Superannuation Minimum pension drawdown rates and calculator. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. A new financial year brings updated thresholds for a range of super measures. Take a look at the new numbers to check for opportunities. the low rate cap amount is the limit set on the amount of taxable components. What Is The Low Rate Threshold For Superannuation.

From www.aph.gov.au

Superannuation changes Parliament of Australia What Is The Low Rate Threshold For Superannuation A new financial year brings updated thresholds for a range of super measures. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. The rate will gradually increase to 12%. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take a look at the new numbers. What Is The Low Rate Threshold For Superannuation.

From www.theaustralian.com.au

Fight over superannuation threshold looms The Australian What Is The Low Rate Threshold For Superannuation A new financial year brings updated thresholds for a range of super measures. The rate will gradually increase to 12%. Minimum pension drawdown rates and calculator. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take. What Is The Low Rate Threshold For Superannuation.

From www.fidelity.com.au

Chart of the week Superannuation Investment Insights Fidelity What Is The Low Rate Threshold For Superannuation Take a look at the new numbers to check for opportunities. A new financial year brings updated thresholds for a range of super measures. Minimum pension drawdown rates and calculator. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. For previous years, see low rate cap amount. The rate will. What Is The Low Rate Threshold For Superannuation.

From www.news.com.au

How much superannuation you should have based on your age What Is The Low Rate Threshold For Superannuation the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Minimum pension drawdown rates and calculator. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. A new financial year brings updated thresholds for a range of super measures. The rate will gradually increase to 12%. Take. What Is The Low Rate Threshold For Superannuation.

From www.cis.org.au

Superannuation tax Why the total balance threshold should be shelved What Is The Low Rate Threshold For Superannuation A new financial year brings updated thresholds for a range of super measures. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Take a look at the new numbers to check for opportunities. For previous years, see low rate cap amount. rates and thresholds apply to contributions, employment termination. What Is The Low Rate Threshold For Superannuation.

From www.prosperityadvisers.com.au

How much Super do you need for a comfortable retirement? Insights What Is The Low Rate Threshold For Superannuation The rate will gradually increase to 12%. A new financial year brings updated thresholds for a range of super measures. For previous years, see low rate cap amount. Minimum pension drawdown rates and calculator. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. rates and thresholds apply to contributions,. What Is The Low Rate Threshold For Superannuation.

From www.walshaccountants.com

Increase to employer super contribution rate Walsh Accountants What Is The Low Rate Threshold For Superannuation rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take a look at the new numbers to check for opportunities. Minimum pension drawdown rates and calculator. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. The rate will gradually increase to 12%. A new financial. What Is The Low Rate Threshold For Superannuation.

From www.listonnewton.com.au

Using superannuation to pay less tax Liston Newton Advisory What Is The Low Rate Threshold For Superannuation For previous years, see low rate cap amount. Minimum pension drawdown rates and calculator. A new financial year brings updated thresholds for a range of super measures. Take a look at the new numbers to check for opportunities. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. rates and. What Is The Low Rate Threshold For Superannuation.

From www.cipaa.com.au

What is superannuation? by Cornell Irving Partners What Is The Low Rate Threshold For Superannuation rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take a look at the new numbers to check for opportunities. The rate will gradually increase to 12%. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Minimum pension drawdown rates and calculator. A new financial. What Is The Low Rate Threshold For Superannuation.

From saveoursuper.org.au

Consequences of increasing the superannuation guarantee rate Save Our What Is The Low Rate Threshold For Superannuation Minimum pension drawdown rates and calculator. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. For previous years, see low rate cap amount. The rate will gradually increase to 12%. Take a look at the new. What Is The Low Rate Threshold For Superannuation.

From bushcampbell.com.au

The latest Self Managed Superannuation updates — Bush & Campbell What Is The Low Rate Threshold For Superannuation For previous years, see low rate cap amount. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Minimum pension drawdown rates and calculator. A new financial year brings updated thresholds for a range of super measures.. What Is The Low Rate Threshold For Superannuation.

From prod.apra.shared.skpr.live

Superannuation in Australia a timeline APRA What Is The Low Rate Threshold For Superannuation rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take a look at the new numbers to check for opportunities. The rate will gradually increase to 12%. For previous years, see low rate cap amount. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Minimum. What Is The Low Rate Threshold For Superannuation.

From www.abc.net.au

The average superannuation fund lost 4,000 last month, but experts say What Is The Low Rate Threshold For Superannuation Minimum pension drawdown rates and calculator. The rate will gradually increase to 12%. For previous years, see low rate cap amount. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. Take a look at the new numbers to check for opportunities. the low rate cap amount is the limit set on the amount of. What Is The Low Rate Threshold For Superannuation.

From matricbseb.com

NZ Superannuation Increase 2024 What is the Increase Amount What Is The Low Rate Threshold For Superannuation Minimum pension drawdown rates and calculator. The rate will gradually increase to 12%. Take a look at the new numbers to check for opportunities. rates and thresholds apply to contributions, employment termination payments, super guarantee and co. For previous years, see low rate cap amount. A new financial year brings updated thresholds for a range of super measures. . What Is The Low Rate Threshold For Superannuation.

From www.baldwinfinancialservices.com.au

Superannuation Rates & Thresholds Baldwin Financial Services What Is The Low Rate Threshold For Superannuation Minimum pension drawdown rates and calculator. A new financial year brings updated thresholds for a range of super measures. the low rate cap amount is the limit set on the amount of taxable components (taxed and untaxed. Take a look at the new numbers to check for opportunities. The rate will gradually increase to 12%. rates and thresholds. What Is The Low Rate Threshold For Superannuation.